Semantic logic in banking: why it breaks down, and how leaders restore it

Banking isn’t just data-heavy, it’s context-dependent. In a perfect world, product, client, and risk data live in a governed ecosystem where every department speaks the same language.

In reality, data is trapped in silos. When logic is fragmented, communication collapses: dashboards don’t match, reports don’t align, and small oversights snowball into regulatory nightmares.

It’s not a lack of talent or investment. It’s a lack of shared semantic logic.

Departments don’t agree on the meaning of data

Imagine starting your day with a barrage of Teams messages:

Risk: "Why doesn’t our exposure dashboard match Finance?”

Finance: "Why did yesterday’s revenue numbers shift overnight?"

Compliance: "We need one more breakdown for the regulator by EOD."

The CEO’s office: "Which of these three numbers is the 'real' one for the board deck?"

Everyone has data. Nobody agrees on what it means.

This isn’t a dashboard problem. It’s not a cloud problem. It’s a meaning problem.

The problem starts at the foundation, causing a breakdown of semantic logic.

4 stages of semantic decay

Stage 1: Dozen of systems, dozens of versions of logic

Banks process millions of transactions daily, using data collected from:

Native banking systems

Risk engines

CRM and customer platforms

Payments, treasury, lending systems

While teams share a core banking system, they also rely on department-specific platforms. This forces them to recreate logic locally, which then gets duplicated or misattributed across environments.

Fragmentation is a by-product of banking’s distributed architecture. It’s inevitable, not because teams are disorganized, but because data and logic live across too many systems at once.

Stage 2: Inconsistent logic slows executive decisions

When semantic logic is fragmented, executive alignment starts to break down.

Terms like “revenue”, “exposure”, “risk” and “customer value” mean different things for different departments.

The most damaging symptoms show up at the leadership level:

Inconsistent dashboards show different numbers

Misaligned KPIs create confusion

Decision-making slows as leaders debate definitions

As a result, executive trust in data erodes, even when teams are operating correctly.

This creates a deeper risk: if leaders can’t agree on definitions, regulators won’t either.

Stage 3: Regulators don’t care about your internal silos

Misaligned data is one thing. Misaligned data under the regulatory microscope is another.

Regulators don’t see your org chart or your legacy system constraints; they only see your numbers. When the Fed or OCC asks for an ad‑hoc stress test, a liquidity report, or a new exposure breakdown, they expect a single, consistent answer.

In a fragmented environment, that request turns into a high‑stakes fire drill because one “simple” misunderstood definition causes chaos.

It turns into a Matter Requiring Attention (MRA/MRIA) that calls for a remediation plan, potential capital add‑ons, constraints on growth initiatives, and uncomfortable conversations with the board about why the bank couldn't produce a single version of the truth on demand.

Stage 4: Data quality becomes relative

Banks invest heavily in data quality. They use monitoring tools, reconciliation processes, and governance frameworks to improve accuracy. Yet data quality remains unreliable.

That’s because the same data is interpreted differently across teams. When semantic logic is divided, data can be “correct” in one system and incorrect in another.

A metric in Risk’s exposure dashboard differs from Finance

Finance’s definition of “revenue” changes reports

Compliance teams clash with regulators over data accuracy

The CEO’s office still lacks clarity on the “real” numbers

As a result, data quality becomes contextual. Each department believes its own version of “correct,” while governance teams manage exceptions instead of enforcing standards.

And as banks move toward automation and AI-driven decisions, this limitation becomes harder to ignore.

AI becomes the ultimate stress test

Modern banks are rolling out AI for everything, from AML monitoring to credit scoring and collections. These aren’t just “tech projects”. They’re high‑risk, regulator‑visible deployments.

But here’s the risk factor: A human analyst might notice that “exposure_amt” in one system doesn’t mean the same thing as “exposure_amount” in another. AI won’t.

It’s a literalist: it assumes the data and definitions it receives are stable and consistent.

In a bank without a shared semantic logic, AI becomes a 'black box' that generates precise-looking errors. Your models can be statistically sound, but if the underlying logic is inconsistent, they will produce results that fail in a regulatory audit.

That’s a risk banks can’t afford. With frameworks like the EU AI Act and risk data aggregation expectations (e.g., BCBS 239), “the model said so” is not a defense.

Banks must be able to show how a decision was made, which data was used, and what each key metric actually meant at the time.

A lack of shared understanding stalls banking operations

Without shared semantic logic, banks struggle to function at every level. AI initiatives stall early because teams debate “what’s real” instead of focusing on “what’s next.” Analysts don’t agree on metrics, VPs struggle to personalize client portfolios, and executives lose visibility into long-term growth.

What banks need is a way to unify semantic logic across the existing data system while remaining scalable, governed, and compliant for the future.

The good news? Banks are recognizing this gap and adopting a solution built to tackle fragmented data systems at the core: the universal semantic layer.

How the universal semantic layer unifies semantic logic

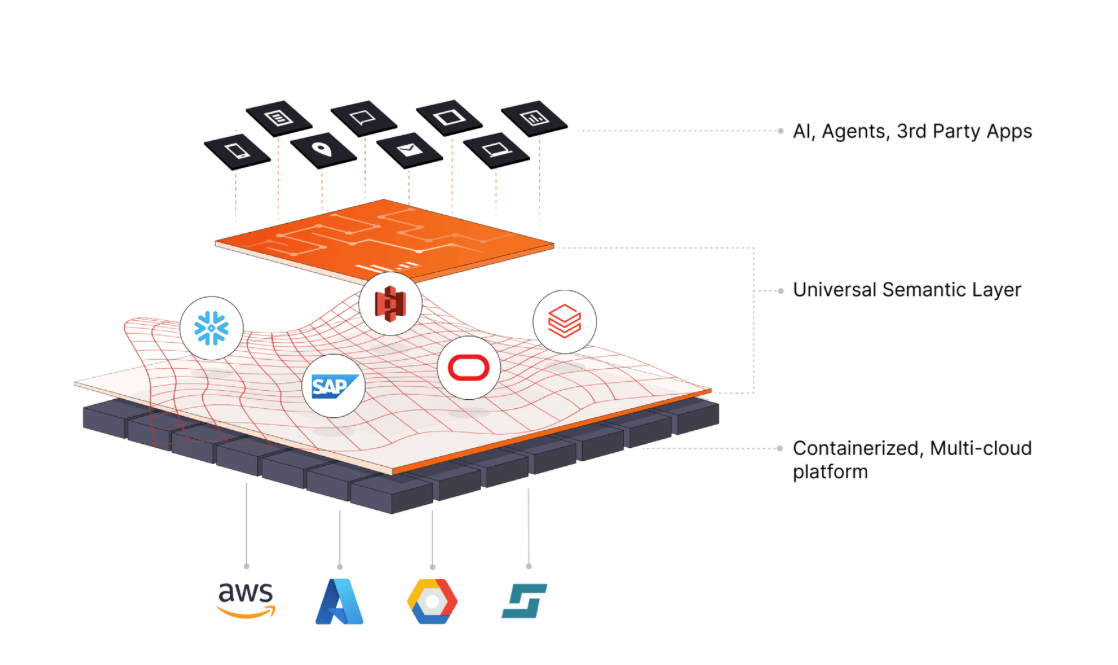

Strategy Mosaic is an enterprise‑grade, AI‑native universal semantic layer that connects your data sources and acts as a “translator,” unifying them under a single business vocabulary.

One Language for All: It centralizes meanings and definitions across the bank so every team interprets metrics consistently. Risk and Finance see the same numbers and share the same understanding, no matter which tools they use.

Decoupled & Scalable: Mosaic’s universal design lets you swap BI tools or cloud providers without rebuilding your logic from scratch. It’s cost‑effective, and its 200+ connectors ensure it grows and adapts with your business.

Centralized Governance: Security and permissions are enforced at the foundational level. Mosaic ensures that only the right people access the right data, with full lineage available for every audit.

AI Readiness: Mosaic defines metrics and relationships once and reuses them everywhere, removing the "guessing game" for AI models. This enables your bank’s AI to deliver accurate insights, scale across tools and teams, and operate from shared semantic logic from day one.

Restoring shared meaning across the bank

Banking relies on consistent data definitions. When they become fragmented across teams, tools, or BI environments, alignment breaks down. Reporting loses focus, and decision‑making slows as meetings create more confusion than clarity.

Strategy Mosaic ensures your product, client, and risk data live inside a governed ecosystem. It centralizes logic and meaning, giving teams a clear data foundation to collect, analyze, and act on insights with confidence.

It protects data quality, unifies reporting, strengthens compliance, and amplifies your AI investment—because everyone finally understands (and agrees on) what your data truly means.

See how your teams can unlock consistent business meaning, governed access, and trusted answers across every tool and AI experience.

Related posts