The Enterprise Analytics Supercycle Has Arrived

These 3 trends are shaping the data and analytics industry for the next decade

For a growing number of large organizations, Enterprise Analytics is no longer a luxury - it’s a necessity.

Enterprise Analytics enables sophisticated brands to collect, analyze, and act upon data across all areas of their business. It puts insights directly in the hands of users. And it provides security and data governance standards (from the top down) while promoting greater levels of collaboration and data democratization (from the ground up).

This whitepaper considers three emerging trends in the data and analytics industry. These trends are converging to create an Enterprise Analytics Supercycle likely to widen the gap between organizations able to maximize their investments in data and analytics, and those that cannot.

Trend 01

Demand for Enterprise Analytics is Escalating

But shifting investment priorities from legacy vendors have customers reconsidering their options.

Adoption of analytics solutions is growing inside enterprises. While the global pandemic did not cause this trend directly, it certainly accelerated it. Demand within and among teams, departments, and organizations has exploded as enterprises work to stay ahead of changes in market trends, customer demands, supply chains, and employee availability.

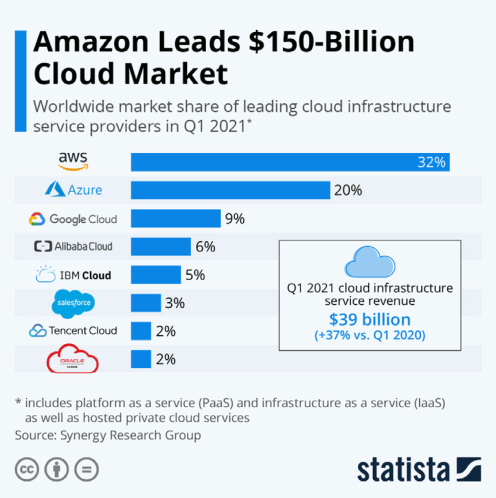

The capacity to rapidly develop and deploy business and productivity applications to users at any location is now essential. To get there, the data-driven are rushing to modernize their analytics as well as move data and business apps to the cloud.

This market shift is putting pressure on mega vendors like IBM Cognos, SAP BusinessObjects, and Oracle OBIEE. They have prioritized moving their ERP and infrastructure customers to the cloud as a defensive measure against the likes of AWS, Azure, and Google. But because of this new strategy, they have deprioritized investments into their own legacy BI applications.

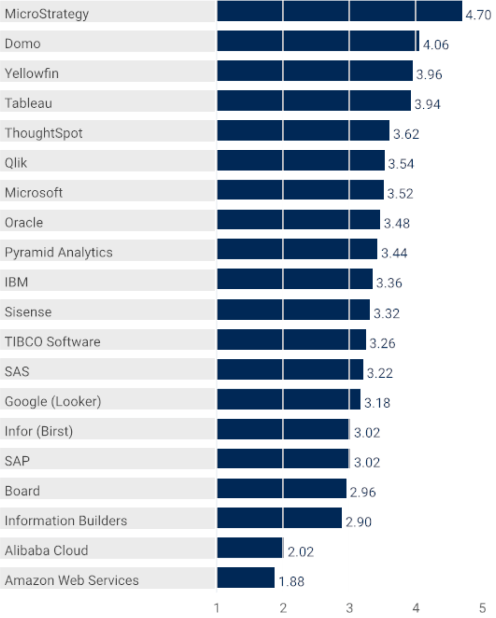

As enterprises now evaluate options to modernize their analytics and BI solutions, MicroStrategy has emerged as the logical vendor of choice because of its full-scale enterprise capabilities—a conclusion substantiated by an acceleration in inquiry, execution, and replacement of mega vendor BI platforms.

Source: Gartner Critical Capabilities for Analytics and Business Intelligence Platforms

Trend 02

Proven Solutions are Replacing Experimental Initiatives

Enterprises are turning to trusted partners that deliver concrete results.

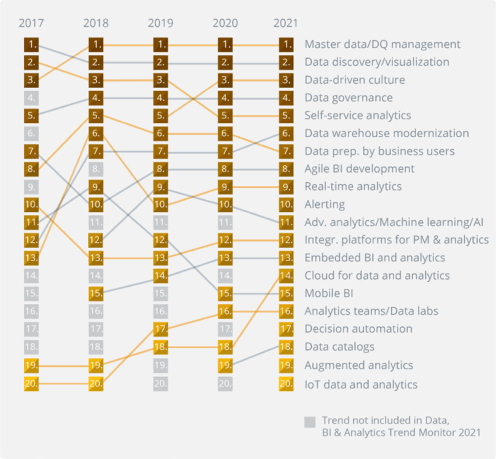

Over the past decade, organizations have supplemented BI and analytics strategies with data initiatives using the latest breakthroughs. These have included NLQ, NLG, AI, ML, and Augmented Analytics. But according to a growing number of industry analysts, these technologies aren’t living up to the hype. And with COVID catalyzing the data-driven to scrap plans and quickly adjust to a landscape transformed, it should come as no surprise that the industry is seeing a broad shift in organizations’ willingness to experiment using these technologies.

It’s predictable for businesses to experience a risk-off of technology investments in times of macro-economic instability. (This was most recently the case with the financial crisis of 2018.) In the short-term, it leads to a focus on outcomes, as well as market consolidation among the most established companies. This putting niche vendors under pressure, as organizations work to avoid fragmenting analytics across departments and increasingly abandon venture capital-type investments.

Source: BARC Research Study Data, BI & Analytics Trend Monitor 2021

Market share of BI Platforms

During this year, enterprises have prioritized the use of a unified platform that can deliver a broad set of use cases. And as a corollary, they are typically seeing significant cost savings through vendor consolidation along with a concurrent cloud- migration strategy.

Source: Gartner Market Share Analytics and BI Platforms, Worldwide 2020

Trend 03

Enterprises are Now Buying (Not Building) Analytics

OEMing and embedding analytics is helping large organizations stay agile.

Every company is a technology company, and those that have embraced this realization are now competing in a technology arms race across industries. Their goal: to seamlessly empower their people with data insights that help outpace the competition. Organizations like Pfizer, Disney, Visa, NICE, and Fanatics are all winning this race thanks in part to a strategic ‘build vs. buy’ decision.

Rather than developing solutions in house, these industry leaders, and a growing number of their contemporaries, are partnering with an open, enterprise-scale technology vendor to leap forward. Pfizer builds R&D solutions in house. Disney, online streaming. And Visa, fin-tech. But each of these market leaders trusts one particular enterprise partner for its analytics—a growing trend in the Embedded Analytics and OEM marketplace.

In choosing a tool, organizations are prioritizing the key components of their vendor platform’s modern clients, open architecture, and enterprise-grade capabilities. And for this subsector of the industry, a robust suite of APIs and SDKs, all code driven, is a requisite to arm developers with agile ways to embed analytics into existing systems, portals, and processes.

Summary

The pressure that has given rise to these trends has been building steadily for years. Coupled with the complexities and challenges caused by COVID, the data-driven have come to embrace Enterprise Analytics—and this supercycle will likely continue for the decade to come. Demand is surging. Experimentation with niche technologies has waned. And market leaders across industries are opting to partner with a vendor that can fully deliver on the promise of Enterprise Analytics: to empower sophisticated brands to collect, analyze, and act upon data across all areas of their business.

If you would like to experience how Enterprise Analytics can empower your organization, MicroStrategy is available to try for free. For more information, click here to get started.