.svg)

PwC’s Transaction Monitoring Solution

Developer

PwC

Industry

FLAME is primarily used by financial institutions for transaction monitoring and compliance. However, its flexible design makes it adaptable to other domains such as insurance, internal audit, supply chain, or IT risk management.

Description

FLAME, enhances detection systems by combining rule-based logic with machine learning-based anomaly detection. It integrates easily into existing environments and enables compliance teams to adapt logic without long release cycles.

Highlights

FLAME improves alert quality and reduces noise by adding real-time, behavior-based analysis to your detection setup. The solution supports in-tool simulation, documentation, and review—giving teams full control without additional tooling.

PwC’s Transaction Monitoring Solution

- PwC’s Transaction Monitoring Solution is designed to help organizations detect and investigate anomalous transactions that may indicate fraud, non-compliance, or operational risk.

- Originally developed to support Anti-Money Laundering (AML) use cases in financial institutions, the solution has since proven effective across a wide range of industries. Whether in insurance, supply chain operations, internal audit, or IT risk management, the system adapts easily to different types of structured data and review processes.

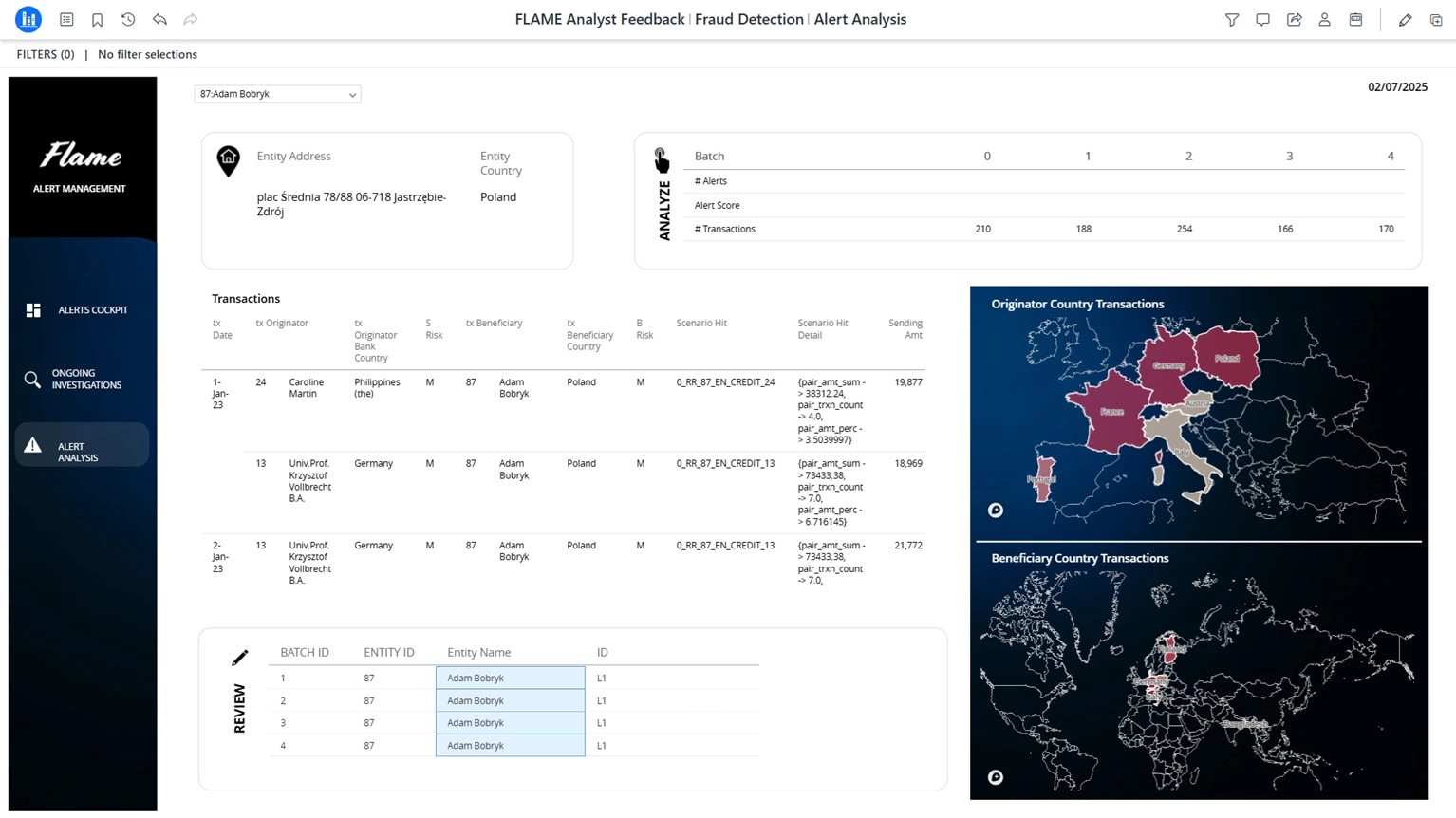

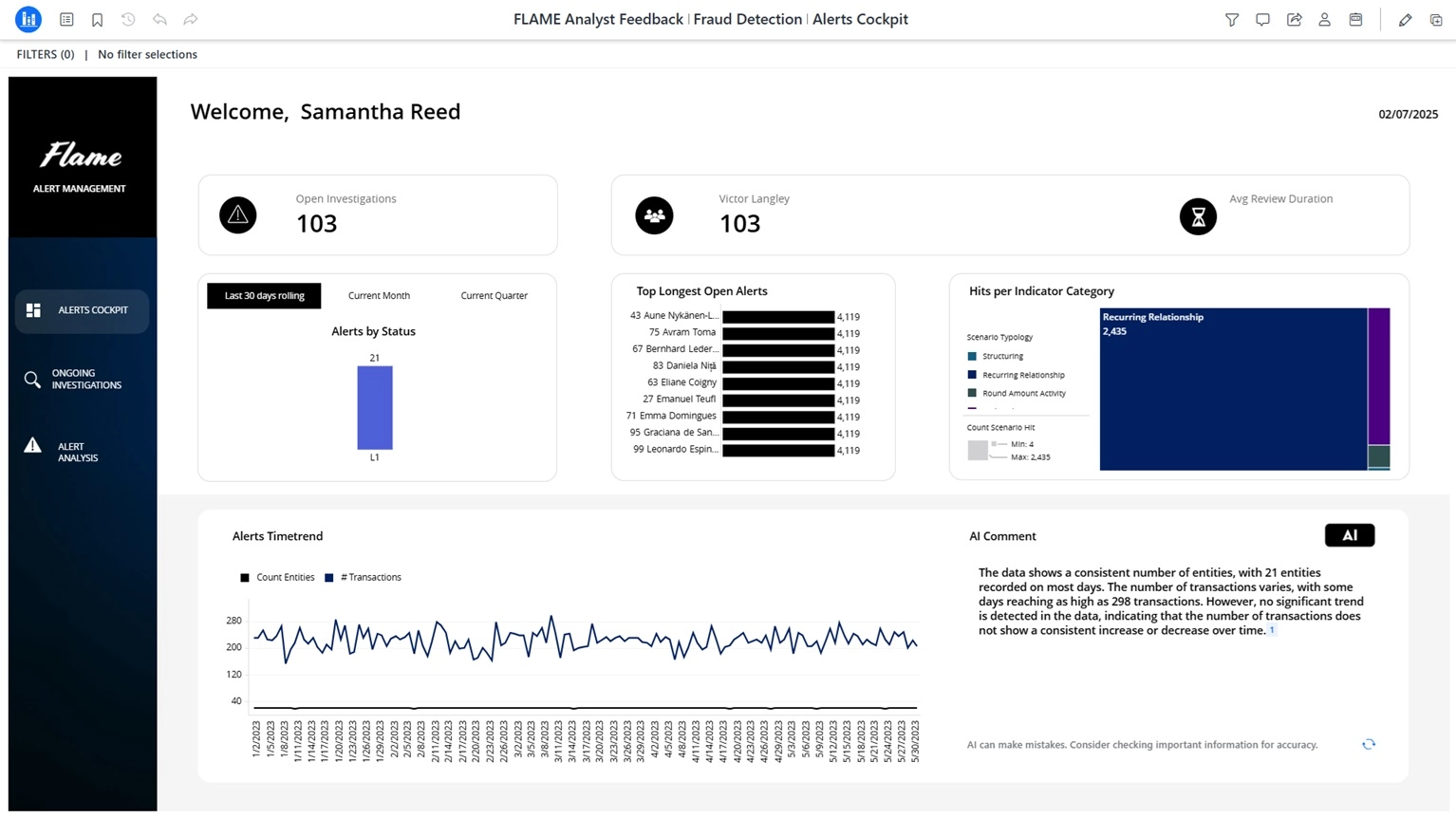

- It automatically analyzes transaction patterns, builds risk indicators, and flags suspicious behavior in real time. Key features include anomaly scoring, case-by-case investigation, rule simulation, documentation workflows, and trend reporting - giving teams the ability to identify emerging risks and respond faster.

Challenges

1. Evolving Threats

Fraud patterns shift faster than static rules can adapt. Criminals use automation and AI to stay just below detection thresholds - leaving rule-based monitoring blind to emerging risks.

2. Stretched Teams

Compliance teams face growing alert volumes with flat headcount. Analysts spend too much time on false positives, manual triage, and fragmented investigations.

3. Misaligned Systems

Full-stack AML solutions are powerful - but rigid. Detection logic is often vendor-driven, slow to update, and disconnected from how analysts actually work.

4. Manual Workarounds

Even with enterprise tooling in place, many teams still use Excel or email for escalations, documentation, and case tracking - introducing inefficiencies and audit gaps.

5. Delayed Response

Batch processing and static rules delay detection. Suspicious transactions may only be flagged after execution - too late to prevent risk exposure.

Benefits

No Rip & Replace

FLAME extends your existing setup—no system overhaul, no disruption to ongoing operations.

No Licensing Lock-In

FLAME is your solution. No recurring license costs, no vendor dependency - you control the code and setup.

Runs Anywhere

Cloud-agnostic by design: deploy on AWS, Azure, GCP, or on-premise - wherever you need it.

Scales with You

Use FLAME as a lightweight pilot or a fully integrated solution - it grows with your needs.

Integrates Easily

Seamlessly connects to existing data flows and workflows—no need to rebuild your architecture.

Use Cases

FLAME originated from a project with Deutsche Bank that needed to enhance its existing AML setup. The solution was built to improve detection coverage through behavioral analytics and streamline the analyst workflow. All lessons learned from that real-world deployment have been incorporated into FLAME — making it a solution grounded in operational reality, not just theory