Why governance is the cornerstone of AI success in financial services

The financial services and insurance industry (FSI) has invested heavily in AI and advanced analytics. So why do so many firms still fail to scale those efforts across the enterprise? The answer isn’t more tools—it’s governance. Discover why a governance-first foundation, supported by an AI-ready semantic layer, is the deciding factor in AI success.

Trust has always been the currency of financial services. In banking, insurance, and capital markets, every decision—whether a million-dollar trade or a life insurance payout—depends on accuracy, security, and trust.

According to the 2025 Global AI+BI Report, 40% of FSI organizations already use AI agents and bots in production. Yet adoption hasn’t translated into scale.

The deeper issue isn’t the AI—it’s the lack of governance to ensure data is accurate, explainable, and compliant. Without it, AI doesn’t just produce inconsistent answers; it produces liabilities that regulators, boards, and customers will not ignore.

Why “AI Hallucinations” pose a strategic risk in financial services

49% of financial services organizations cite inconsistent or inaccurate answers as their biggest analytics challenge. These inconsistencies, often referred to as “AI hallucinations”, aren’t harmless glitches. They create strategic risks: eroding customer trust, triggering compliance concerns, and exposing executives to regulatory scrutiny.

Financial institutions pull data from a wide range of sources, including:

- Core banking and insurance systems

- CRM and ERP systems

- Payment networks and clearing systems

- Fintech and open banking APIs

- Regulatory and compliance data sources

- Digital channels

Each system speaks a different language. Each applies different rules.

Over time, this fragmentation creates multiple versions of the truth, making it impossible to get a single, governed view of customers, transactions, or risk exposure.

And in financial services, that isn’t just inefficient. It means decisions based on AI can’t stand up in an audit—and that’s a failure no boardroom or regulator will tolerate.

Five barriers, one root cause: Missing governance in AI+BI

The risks of “AI hallucinations” are just the tip of the iceberg. Financial services organizations face five systemic barriers that prevent AI from scaling safely and profitably:

- Inconsistent answers erode trust, slow decision-making, and put executives on the defensive with regulators.

- Security and compliance risks dominate the boardroom—cited by 80% of FSI leaders.

- Vendor lock-in turns every merger, reorganization, or cloud migration into a governance nightmare.

- Rising costs—from compute usage, data movement, and duplicated logic—undermine ROI at the very moment firms need efficiency.

- Growing complexity across federated systems makes it nearly impossible to enforce governance at scale.

Each of these problems looks different in isolation, but they all stem from a single root cause: governance that hasn’t kept pace with enterprise complexity.

As detailed in the whitepaper Governance first: The key to scalable, trusted AI+BI in financial services, solving these challenges isn’t about adding more tools. It requires a governance-first foundation that unifies policies, definitions, and controls—so AI can scale with confidence, not chaos.

Why a governance-first approach matters in financial services

Unlike consumer tech or retail, financial services operate under constant regulatory scrutiny.

From data privacy to model explainability, compliance isn’t optional—it’s embedded in every transaction, policy, and audit.

Yet many AI initiatives in FSI fail because they rely on disconnected tools, embedded logic, and siloed access policies. The result? Inconsistent insights, security blind spots, and escalating operational costs.

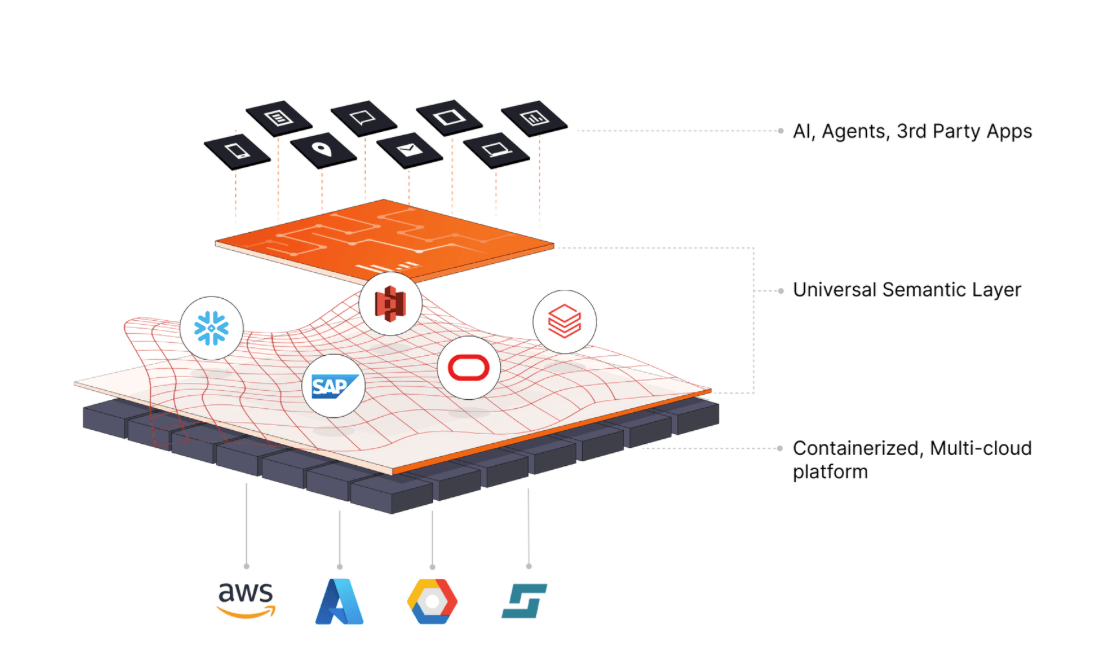

A governance-first approach changes this. It shifts analytics from tool-specific rules to a consistent, enterprise-wide framework for data and AI. Supporting enablers—like a universal semantic layer—operationalize that framework by ensuring definitions, rules, and permissions flow consistently across every platform.

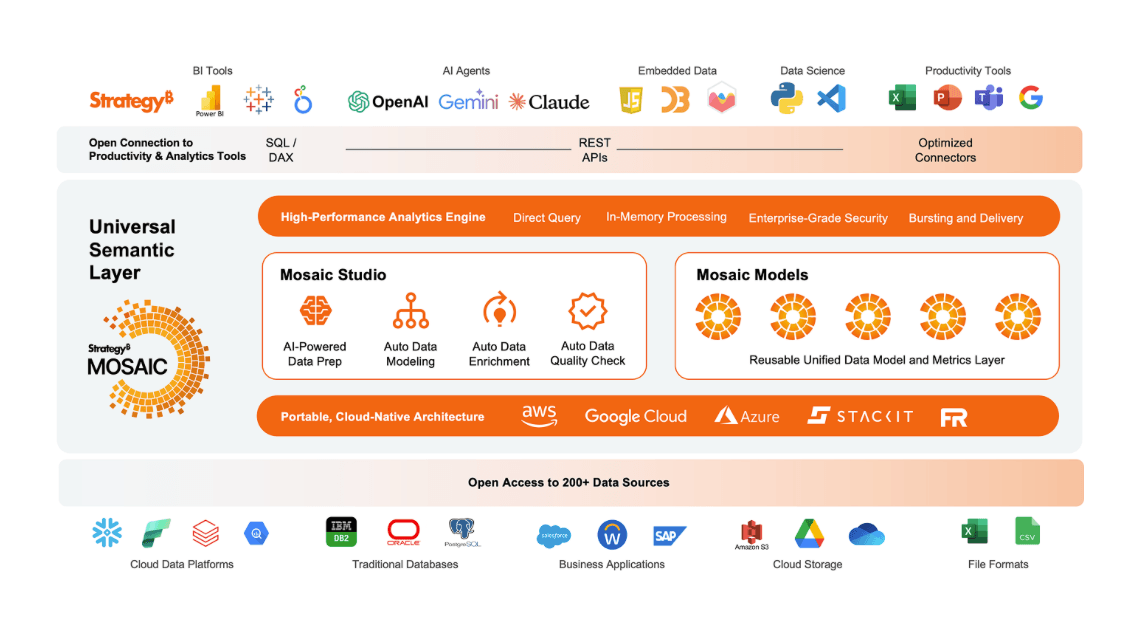

That’s the approach behind Strategy Mosaic: a governance-first foundation that makes AI explainable, auditable, and ready to scale in financial services.

How Strategy Mosaic operationalizes governance in AI+BI

Strategy Mosaic is a universal semantic layer that sits above your data layer, unifying business definitions, access rules, and modeling logic once—so they can be reused everywhere.

For financial services organizations, this governance-first approach delivers four key advantages:

- Clarity in critical metrics: No more conflicting definitions of revenue, risk exposure, or product performance.

- Consistent security: Row-, column-, and feature-level controls applied uniformly across all BI tools and AI interfaces.

- Freedom from vendor lock-in: Independence from cloud, data, and tool providers makes transitions, mergers, and audits far less disruptive.

- Efficiency at scale: Smart caching and automation reduce compute costs while accelerating insights

The result isn’t just better analytics—it’s trusted, explainable, and secure intelligence at enterprise scale.

Build trust. Reduce risk. Scale with confidence.

In financial services, consistency is everything. Every misalignment—whether in revenue definitions or data access rights—carries reputational, regulatory, and financial risk.

At the same time, the pressure to innovate and serve customers faster has never been higher. Boards and regulators expect both: speed and control.

A governance-first foundation is how financial services leaders reconcile the two.

It enables innovation without sacrificing oversight—and positions firms to scale AI confidently, even in complex, multi-cloud environments.

The takeaway is clear: governance isn’t just an IT priority—it’s the enterprise foundation for trusted, scalable AI.