Banco Hipotecario: How to Leverage Data & AI for a Competitive Edge

Struggling with fragmented data and outdated reporting? See how Banco Hipotecario switched from Power BI and transformed decision-making with Strategy’s AI-powered insights — unlocking real-time analytics and a seamless data experience with the Semantic Layer.

Banco Hipotecario S.A. is a commercial bank and mortgage lender in Argentina.

Established in 1886, Banco Hipotecario has granted over 2 million housing loans across the country.

Today, Banco Hipotecario offers comprehensive solutions in credit, savings, and investment for families, companies, and public-sector organizations.

.png&w=3840&q=100)

The Challenge

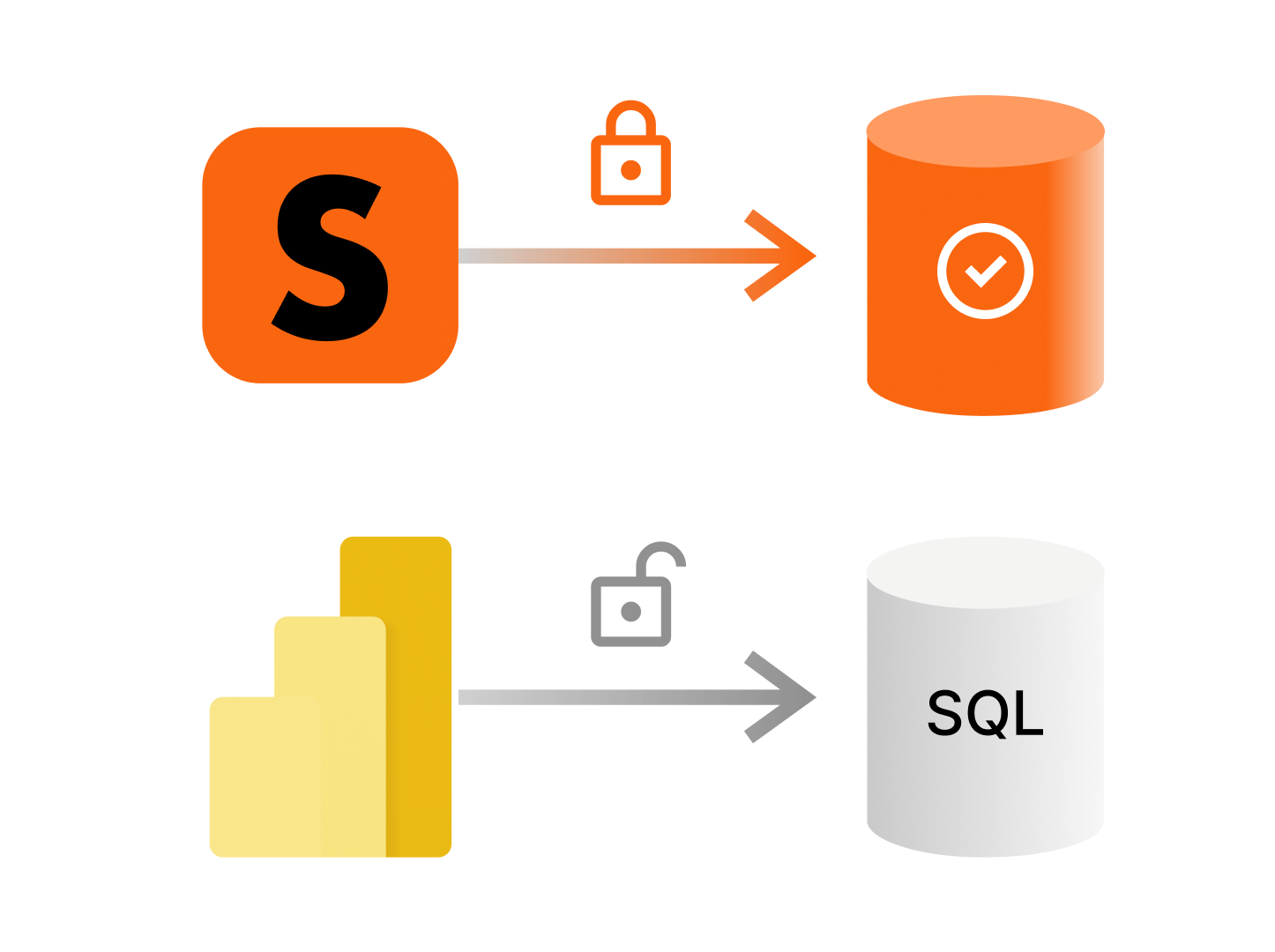

Banco Hipotecario used Microsoft Power BI to collect their data insights but was struggling to consolidate information and make truly data-driven decisions.To understand the gaps, Banco Hipotecario conducted an in-depth assessment of Power BI’s capabilities—uncovering critical issues that led to data silos and threatened their data-first strategy.

Microsoft Power BI consisted of disjointed software which was not built to work together seamlessly as one.

Discover a more integrated approach to consolidate data and drive strategic decision-making.

The Problems

Lack of Dynamic Reporting

Power BI did not provide real-time data analysis or dynamic interaction with the data. This caused inefficiencies and a high burden of manual report creation.

Disjointed Reporting Practices

Multiple teams within the bank were generating their own reports, causing a lack of cohesion and consistency in the data being reported.

Reports Stuck at End Users

Once reports were created, they often got stuck at the end-user level. Users received the reports, but there was no effective way for them to interact with, analyze, or act on this data dynamically.

Critical Data Management Issues

There was an unregulated SQL server containing 60 terabytes of data, constantly accessed by users but lacking proper regulation and governance.

The Solutions

Banco Hipotecario leveraged Strategy One’s powerful Semantic Layer — a game-changer for organizations looking to unify data and eliminate silos. Instead of struggling with fragmented reports, the bank accessed a single source of truth, ensuring accurate and accessible insights for all teams.

Next, they integrated Strategy One’s conversational AI Auto Bot, capable of understanding simple language. The Auto Bot provided precise forecasting, allowing the bank to better anticipate market trends and optimize future strategy.

Moreover, by adopting Strategy One’s generative AI capabilities, Banco Hipotecario automated dashboards and report creation, freed up valuable time, and reduced reliance on dedicated teams for dashboard management.

This feature became particularly valuable for middle managers and top executives, enabling them to make informed decisions faster without waiting for manual reports.

Strategy One Features Leveraged by Banco Hipotecario

Banco Hipotecario found the solution in Strategy One, the AI-powered BI platform designed to simplify data management and enhance decision-making.

The Semantic Layer

Simplified data interactions by translating technical metadata into business-friendly terms, making insights easily accessible across the organization.

AI Analytics

With built-in AI, Banco Hipotecario quickly uncovered insights through conversational AI, created sophisticated dashboards, and developed custom AI-powered solutions.

Embedded Analytics

Provided advanced visuals, branded reports, and open APIs for seamless customization—ensuring a tailored, self-service analytics experience.

“We built a centralized browser that consolidates all our available reports, providing our organization with a single window for access.”

— Product Representative at Banco Hipotecario

The Results

Streamlined Reporting

A centralized system eliminated reporting delays, ensuring that insights reached the right people at the right time.

Interactive Reporting

AI-powered analytics transformed reports into real-time, interactive dashboards, making insights more actionable.

Unified Data Management

The Semantic Layer established a single source of truth, improving data consistency and reliability across the organization.

Self-Service Model

Teams gained independent access to data, eliminating bottlenecks and enabling faster, data-driven decisions.

On-Demand Webinar

Discover how Banco Hipotecario used Strategy One to transform their analytics and:

Unlock up-to-date reporting

Empower self-service data access

Improve data integrity and control

Enhance decision-making

The Future

In the past, Power BI’s fragmented system had been problematic and error-prone. With Strategy One, Banco Hipotecario transformed its approach to data integration, reporting, and governance—leading to smarter decision-making and greater efficiency.

Banco Hipotecario streamlined reporting, unified data channels, and empowered teams with real-time insights. Strategy One helped the bank build a more agile, data-driven organization.

Looking ahead, Banco Hipotecario is excited to continue innovating with Strategy One, unlocking new opportunities to stay ahead in the competitive banking sector.

Trusted by some of the world's most well-known and demanding organizations